40 coupon rate bond formula

Current Yield of Bond Formula - EDUCBA Current Yield = Annual Coupon Payment / Current Market Price of Bond * 100%. Relevance and Use of Current Yield of Bond Formula. From the perspective of a bond investor, it is important to understand the concept of current yield because it helps in the assessment of the expected rate of return from a bond currently. What Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

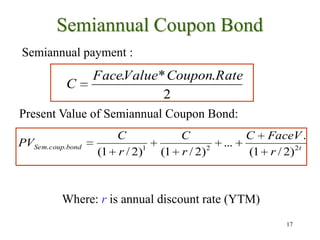

Coupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50 .

Coupon rate bond formula

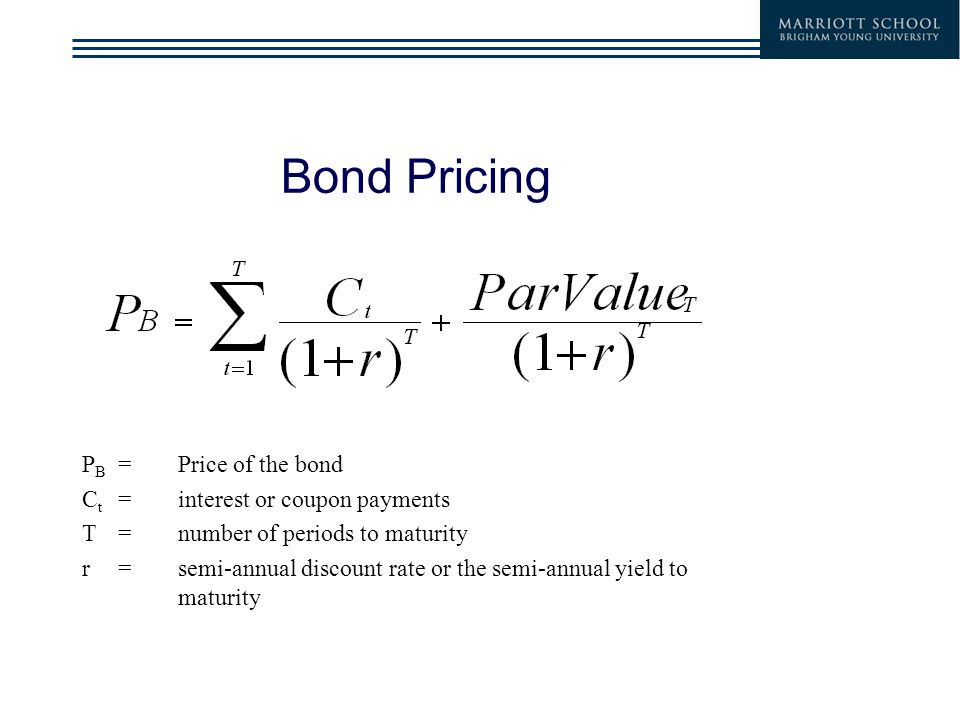

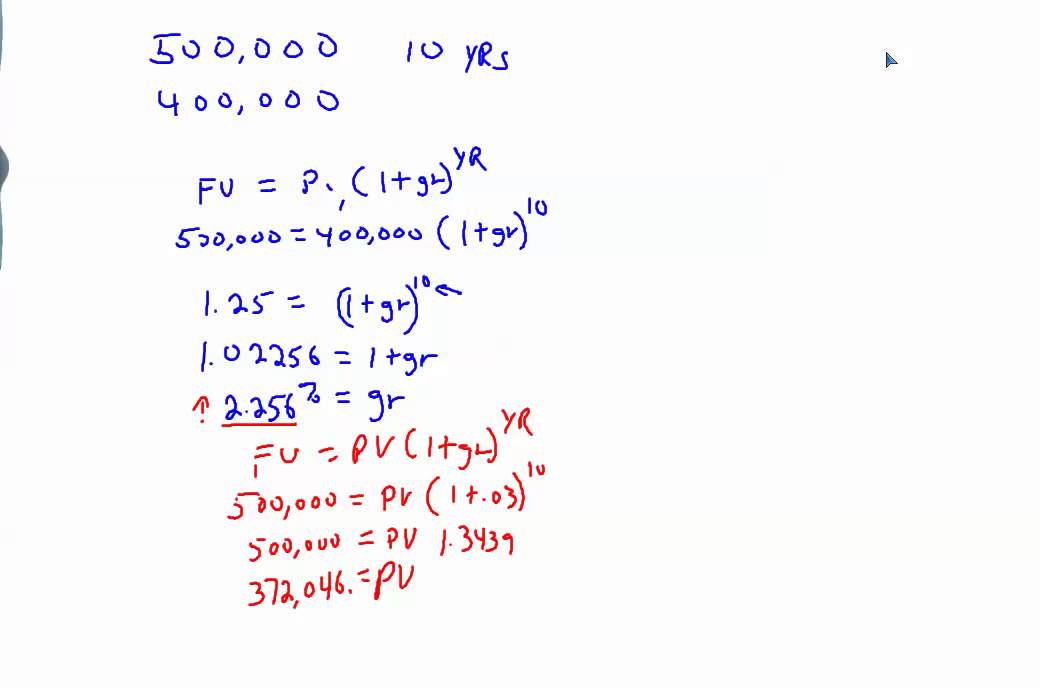

Bond Valuation: Formula, Steps & Examples - Study.com Jan 05, 2022 · Bond Terms. Horse Rocket Software has issued a five-year bond with a face value of $1,000 and a 10% coupon rate. Interest is paid annually. Similar bonds in the market have a discount rate of 12%. Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ... Coupon Rate of a Bond (Formula, Definition) | Calculate ... Finally, the formula of the coupon rate of the bond is calculated by dividing the annualized interest payments by the par value of the bond and multiplied by 100%, as shown below. Examples Let us take the example of a bond with quarterly coupon payments.

Coupon rate bond formula. What is Bond Yield? (Formula + Calculator) - Wall Street Prep Step 2: The annual coupon is a function of the bond’s coupon rate, par value, and payment frequency – and, if applicable, the coupon rate must be annualized. Step 3 : The current yield formula equals the annual coupon payment divided by the bond’s current market price, expressed as a percentage. Coupon Rate of a Bond (Formula, Definition) | Calculate ... Finally, the formula of the coupon rate of the bond is calculated by dividing the annualized interest payments by the par value of the bond and multiplied by 100%, as shown below. Examples Let us take the example of a bond with quarterly coupon payments. Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ... Bond Valuation: Formula, Steps & Examples - Study.com Jan 05, 2022 · Bond Terms. Horse Rocket Software has issued a five-year bond with a face value of $1,000 and a 10% coupon rate. Interest is paid annually. Similar bonds in the market have a discount rate of 12%.

Post a Comment for "40 coupon rate bond formula"