40 perpetual zero coupon bond

Economic growth - Wikipedia Economic growth can be defined as the increase or improvement in the inflation-adjusted market value of the goods and services produced by an economy over a certain period of time. Statisticians conventionally measure such growth as the percent rate of increase in the real gross domestic product, or real GDP.. Growth is usually calculated in real terms – i.e., inflation … en.wikipedia.org › wiki › Zero-Coupon_InflationZero-Coupon Inflation-Indexed Swap - Wikipedia The Zero-Coupon Inflation Swap (ZCIS) is a standard derivative product which payoff depends on the Inflation rate realized over a given period of time. The underlying asset is a single Consumer price index (CPI). It is called Zero-Coupon because there is only one cash flow at the maturity of the swap, without any intermediate coupon.

› newyorkCBS New York - Breaking News, Sports, Weather, Traffic and ... Latest breaking news from New York City. A Look Back: Major blackout hits New York City on July 13, 1977 On July 13, 1977, 45 years ago Wednesday, a major blackout hit New York City.

Perpetual zero coupon bond

Mortgage-backed security - Wikipedia A mortgage bond is a bond backed by a pool of mortgages on a real estate asset such as a house. More generally, bonds which are secured by the pledge of specific assets are called mortgage bonds. Mortgage bonds can pay interest in either monthly, quarterly or semiannual periods. The prevalence of mortgage bonds is commonly credited to Unbanked American households hit record low numbers in 2021 25/10/2022 · The number of American households that were unbanked last year dropped to its lowest level since 2009, a dip due in part to people opening accounts to receive financial assistance during the ... en.wikipedia.org › wiki › Mortgage-backed_securityMortgage-backed security - Wikipedia Just as this article describes a bond as a 30-year bond with 6% coupon rate, this article describes a pass-through MBS as a $3 billion pass-through with 6% pass-through rate, a 6.5% WAC, and 340-month WAM. The pass-through rate is different from the WAC; it is the rate that the investor would receive if he/she held this pass-through MBS, and ...

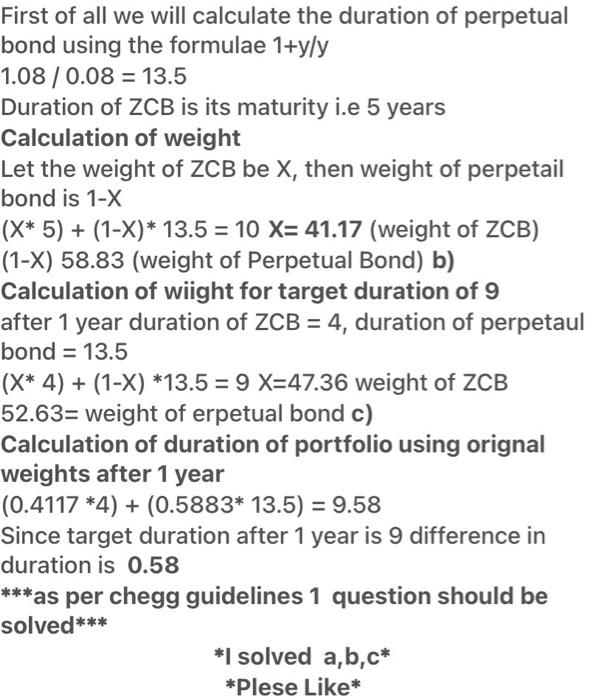

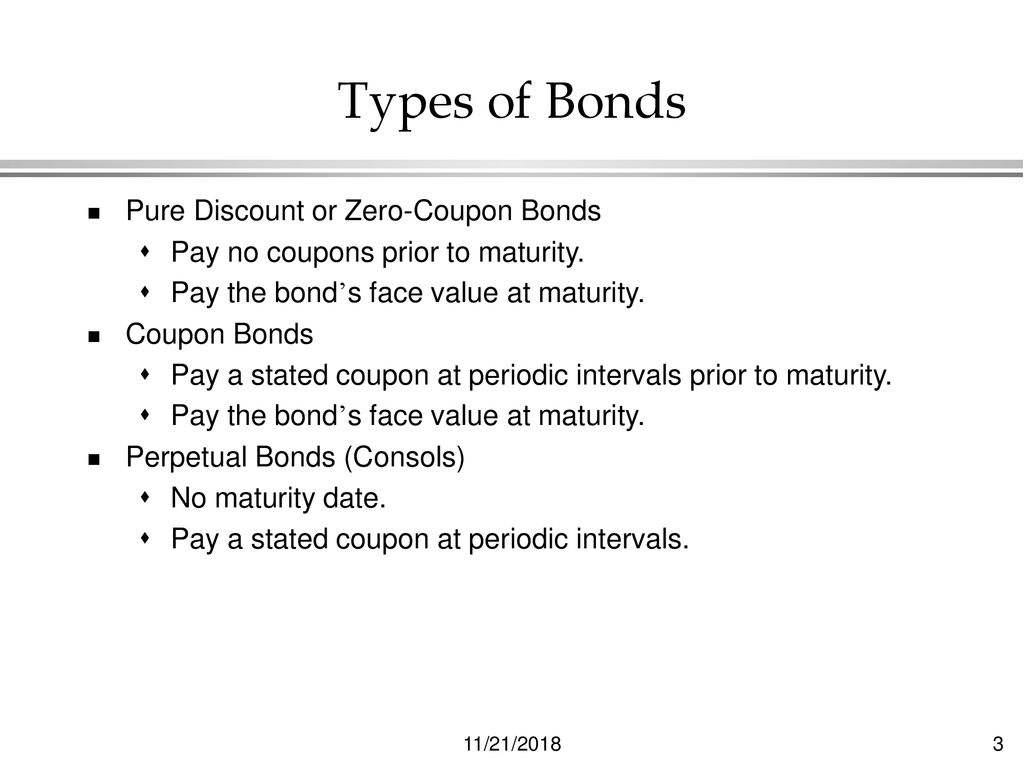

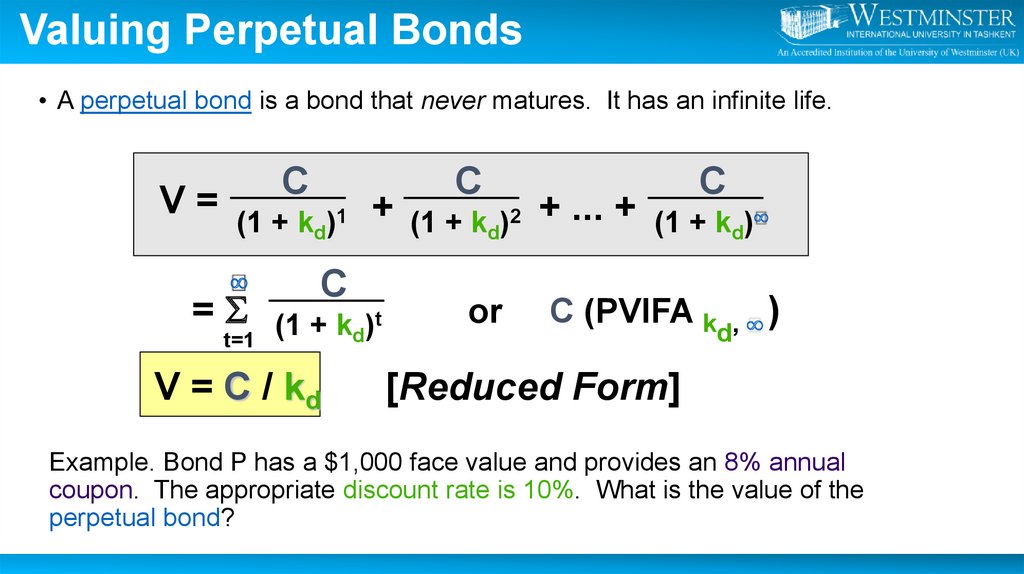

Perpetual zero coupon bond. Zero-Coupon Inflation-Indexed Swap - Wikipedia The Zero-Coupon Inflation Swap (ZCIS) is a standard derivative product which payoff depends on the Inflation rate realized over a given period of time. The underlying asset is a single Consumer price index (CPI).. It is called Zero-Coupon because there is only one cash flow at the maturity of the swap, without any intermediate coupon.. It is called Swap because at maturity … › terms › pPerpetual Bond: Definition, Example, Formula To Calculate Value Mar 19, 2020 · Perpetual Bond: A perpetual bond is a fixed income security with no maturity date . One major drawback to these types of bonds is that they are not redeemable. Given this drawback, the major ... Achiever Papers - We help students improve their academic standing All our academic papers are written from scratch. All our clients are privileged to have all their academic papers written from scratch. These papers are also written according to your lecturer’s instructions and thus minimizing any chances of plagiarism. Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds …

en.wikipedia.org › wiki › United_States_TreasuryUnited States Treasury security - Wikipedia Treasury bonds (T-bonds, also called a long bond) have the longest maturity at twenty or thirty years. They have a coupon payment every six months like T-notes.. The U.S. federal government suspended issuing 30-year Treasury bonds for four years from February 18, 2002, to February 9, 2006. › gamingVideo Game News & Reviews | Engadget Find in-depth news and hands-on reviews of the latest video games, video consoles and accessories. United States Treasury security - Wikipedia Treasury bills (T-bills) are zero-coupon bonds that mature in one year or less. They are bought at a discount of the par value and, instead of paying a coupon interest, are eventually redeemed at that par value to create a positive yield to maturity.. Regular T-bills are commonly issued with maturity dates of 4, 8, 13, 17, 26 and 52 weeks, each of these approximating a different … Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, …

› newsletters › entertainmentCould Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal. Perpetual Bond: Definition, Example, Formula To Calculate Value 19/03/2020 · Perpetual Bond: A perpetual bond is a fixed income security with no maturity date . One major drawback to these types of bonds is that they are not redeemable. Given this drawback, the major ... Microsoft Outlook Personal Email and Calendar | Microsoft 365 Download free Microsoft Outlook email and calendar, plus Office Online apps like Word, Excel, and PowerPoint. Sign in to access your Outlook email account. en.wikipedia.org › wiki › Mortgage-backed_securityMortgage-backed security - Wikipedia Just as this article describes a bond as a 30-year bond with 6% coupon rate, this article describes a pass-through MBS as a $3 billion pass-through with 6% pass-through rate, a 6.5% WAC, and 340-month WAM. The pass-through rate is different from the WAC; it is the rate that the investor would receive if he/she held this pass-through MBS, and ...

Unbanked American households hit record low numbers in 2021 25/10/2022 · The number of American households that were unbanked last year dropped to its lowest level since 2009, a dip due in part to people opening accounts to receive financial assistance during the ...

Mortgage-backed security - Wikipedia A mortgage bond is a bond backed by a pool of mortgages on a real estate asset such as a house. More generally, bonds which are secured by the pledge of specific assets are called mortgage bonds. Mortgage bonds can pay interest in either monthly, quarterly or semiannual periods. The prevalence of mortgage bonds is commonly credited to

Post a Comment for "40 perpetual zero coupon bond"