38 coupon rate of bond

Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing | Wall Street ... The coupon rate is the interest that a bond pays when it is issued. For example, a $100,000 bond with a coupon rate of 2.5% will pay $2500 per year. The interest is usually split into several payments throughout the year. Everything You Need To Master Excel Modeling To Help You Thrive in the Most Prestigious Jobs on Wall Street. Learn More

What Is a Coupon Rate? And How Does It Affects the Price of a Bond? To calculate the bond coupon rate, total annual payments need to be divided by the bond's par value. Annual payments = $ 50 Coupon rate = $500 / $1,000 = 0.05 The bond's coupon rate is 5 percent. This is the portion of bond that shall be paid every year. How the Coupon Rate Affects the Price of a Bond?

Coupon rate of bond

Coupon Rate Structure of Bonds — Valuation Academy 1) Fixed Rate Bonds have a constant coupon rate throughout the life of the bond. For example: a Treasury bond with face amount (or principal amount) $1000 that has a 4% coupon and matures 6 years from now, the U.S. Treasury has to pay 4% of the par value ($40) each year for 6 years and the par value ($1000) at the end of 6 years. dqydj.com › bond-yield-to-call-calculatorBond Yield to Call (YTC) Calculator - DQYDJ Coupon Payment Frequency - How often the bond makes coupon payments. Bond YTC Calculator Outputs. Yield to Call (%): The converged upon solution for the yield to call of the current bond (the internal rate of return assuming the bond is called). Current Yield (%): The simple calculated yield which uses the current trading price and face value ... › ask › answersBond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's...

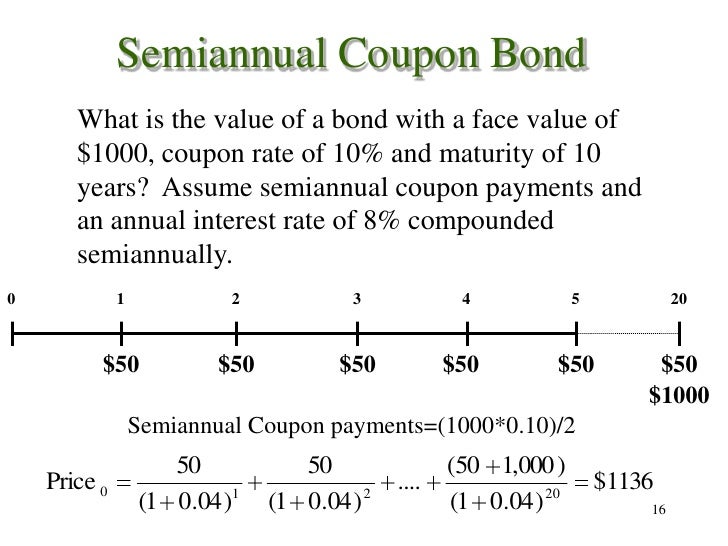

Coupon rate of bond. Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment. Coupon Rate Bond - The Strategic CFO™ Bond coupon rates are quoted as annual rates, but the bond coupons are typically paid semi-annually. For example, an investor holding a bond with a $1,000 face value and a 10% annual bond coupon will receive $100 in interest yearly until the bond matures. What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. › coupon-bond-formulaCoupon Bond Formula | Examples with Excel Template Step 2: Next, figure out the rate of annual coupon and based on that calculate the periodic coupon payment of the bond. The coupon payment is the product of the coupon rate and the par value of the bond. It also does not change over the course of the bond tenure. The annual coupon payment is denoted by C and mathematically represented as shown ...

› Calculate-Bond-Discount-RateHow to Calculate Bond Discount Rate: 14 Steps (with Pictures) Jan 12, 2020 · A bond discount is the difference between the face value of a bond and the price for which it sells. The face value, or par value, of a bond is the principal due when the bond matures. Bonds are sold at a discount when the market interest rate exceeds the coupon rate of the bond. In order to calculate how the amount of the bond discount, you ... What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same. What is the Coupon Rate? - Realonomics What is the coupon rate on a bond that has a par value of 1000? Where is the coupon rate on a BA II Plus? What is the PMT formula? Why is lower coupon rate high risk? What interest rates are? When the coupon rate on a bond is equal to the yield to maturity the price of the bond will be Mcq? Coupon Rate Definition & Example | InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying the coupon based on the face value of the bond.

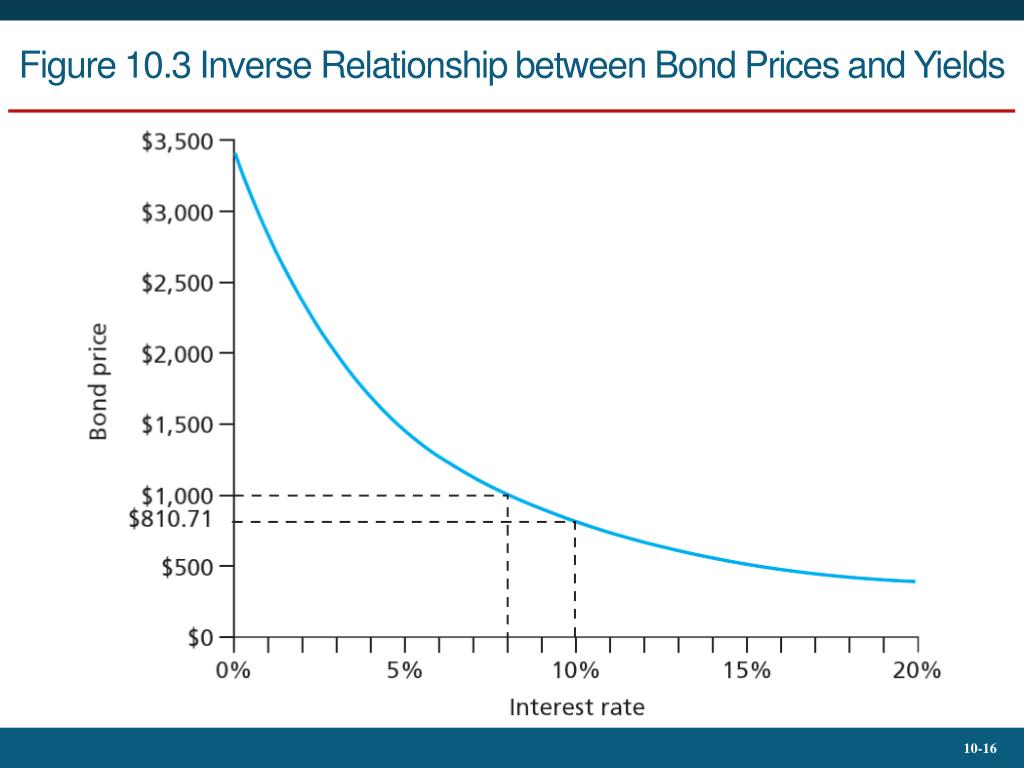

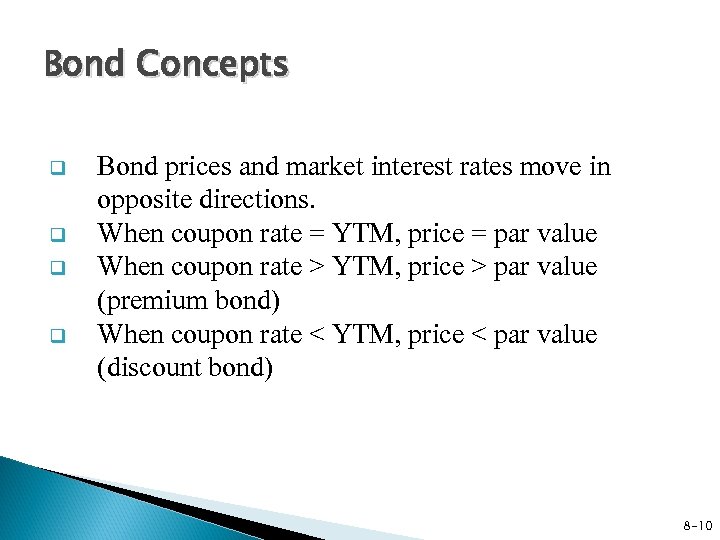

What is a Coupon Rate? | Bond Investing | Investment U Coupon rates play a significant role in dictating demand for certain bonds. They come fixed at the time of issuance, while interest rates change. This means the two work in tandem to drive bond prices—and thus, demand for bonds. If the rate is higher than the current interest rate, bonds will trade at a premium. Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 How to Find Coupon Rate of a Bond on Financial Calculator Coupon Rate = (Coupon Payment / Par Value) x 100 For example, you have a $1,000 par value bond with an annual coupon payment of $50. The bond has 10 years until maturity. Using the formula above, we would calculate the coupon rate as follows: Coupon Rate = ($50 / $1,000) x 100 = 5% Own or Dealer Bid WHAT IS COUPON RATE OF A BOND - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment. A point ...

› terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

What is a Coupon Rate? - Definition | Meaning | Example Other bonds may pay interest every three months. In order to calculate the coupon rate formula of a bond, we need to know: the face value of the bond, the annual coupon rate, and the number of periods per annum. Let's look at an example. Example. The coupon payment on each bond is $1,000 x 8% = $80.

Coupon Types - Financial Edge Training With a fixed-rate bond such as a 10-year, 3% coupon annual bond, the investor knows exactly what interest payments will be received every year until maturity. This is assuming that the bond issuer does not default at any point in time. There is a special type of fixed-rate bond called a zero-coupon bond.

Coupon Bond | Coupon Bond Price | Examples of Coupon Bond Example #1. Let us take the example of a debt raised by ASD Inc. in the form of a bond that pays coupons annually. The par value of the bond is $1,000, coupon rate is 5% and number of years until maturity is 10 years. Determine the price of the CB if the yield to maturity is 4%. Popular Course in this category.

› coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

Coupon Rate | Investor.gov Glossary Coupon Rate The interest rate on a bond. It is expressed as a semi-annual rate.

Coupon Rate of a Bond - Harbourfront Technologies Based on these steps, the formula to calculate the coupon rate of a bond is as follows. Coupon Rate of a Bond = Total Annual Coupon Payment / Par Value of Bond x 100%. For example, a bond offers a total annual coupon payment of $50. The bond 's par value is $1,000. Therefore, its coupon rate will be 5% ($50 / $1,000 x 100).

Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .)

Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders.

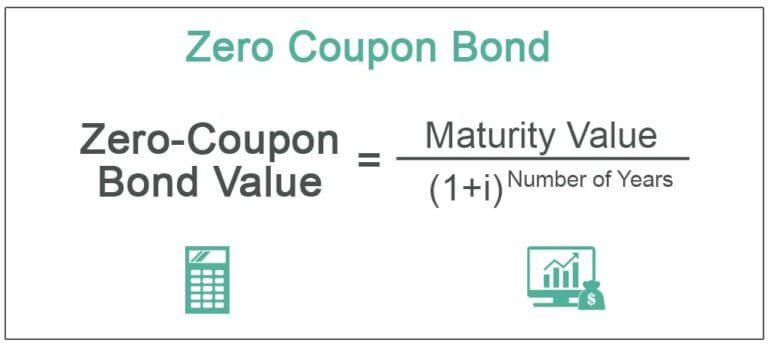

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

smartasset.com › investing › bond-coupon-rateWhat Is Coupon Rate and How Do You Calculate It? Dec 03, 2019 · To calculate the bond coupon rate we add the total annual payments then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate.

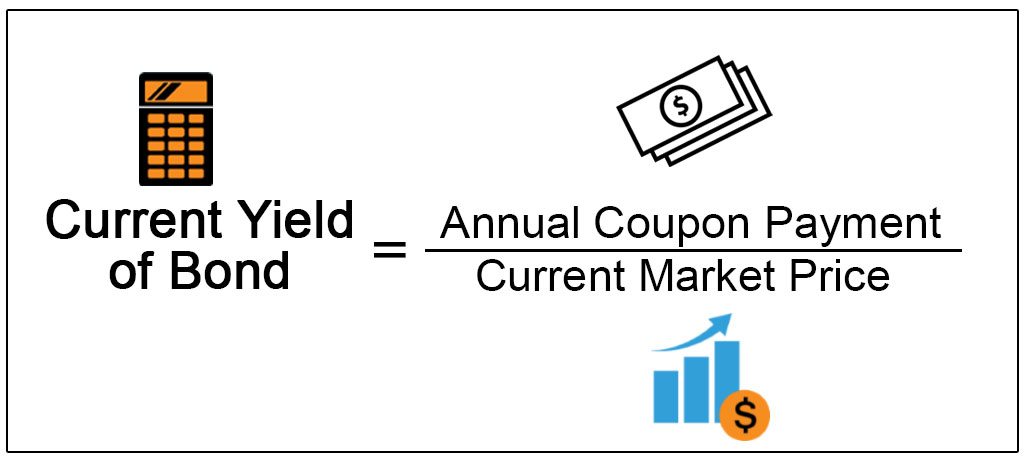

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

› ask › answersBond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's...

dqydj.com › bond-yield-to-call-calculatorBond Yield to Call (YTC) Calculator - DQYDJ Coupon Payment Frequency - How often the bond makes coupon payments. Bond YTC Calculator Outputs. Yield to Call (%): The converged upon solution for the yield to call of the current bond (the internal rate of return assuming the bond is called). Current Yield (%): The simple calculated yield which uses the current trading price and face value ...

Coupon Rate Structure of Bonds — Valuation Academy 1) Fixed Rate Bonds have a constant coupon rate throughout the life of the bond. For example: a Treasury bond with face amount (or principal amount) $1000 that has a 4% coupon and matures 6 years from now, the U.S. Treasury has to pay 4% of the par value ($40) each year for 6 years and the par value ($1000) at the end of 6 years.

Post a Comment for "38 coupon rate of bond"