45 ytm and coupon rate

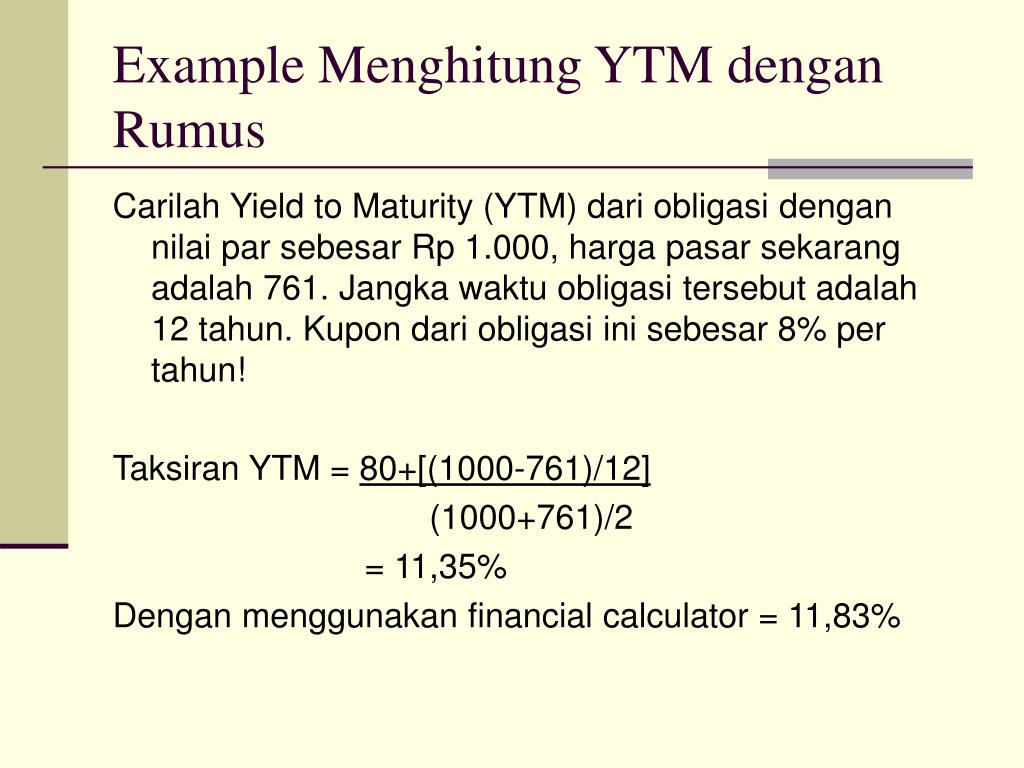

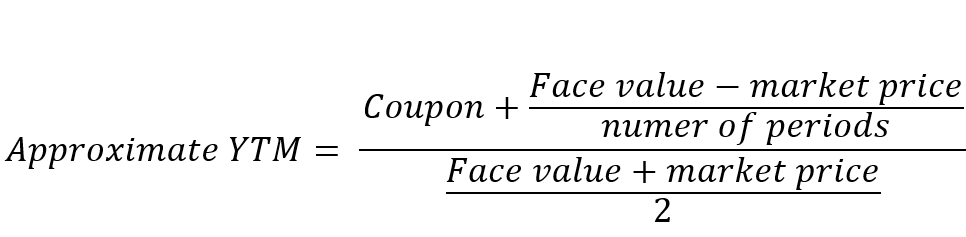

Yield to Maturity (YTM) - Overview, Formula, and Importance The coupon rate Coupon Rate A coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

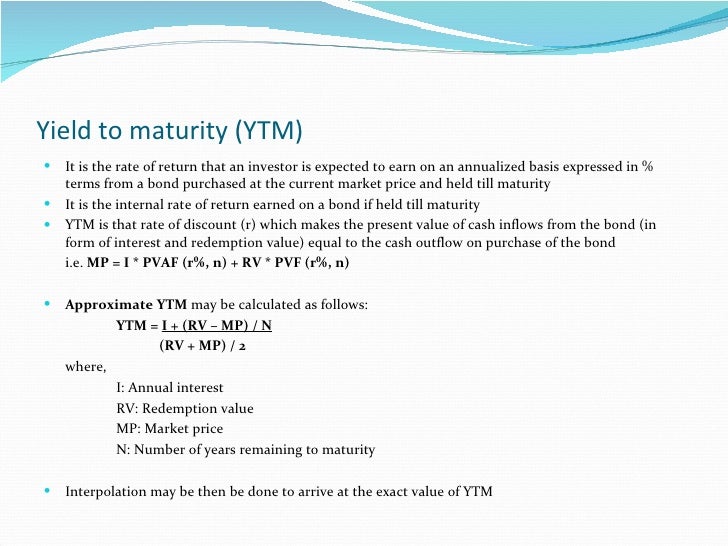

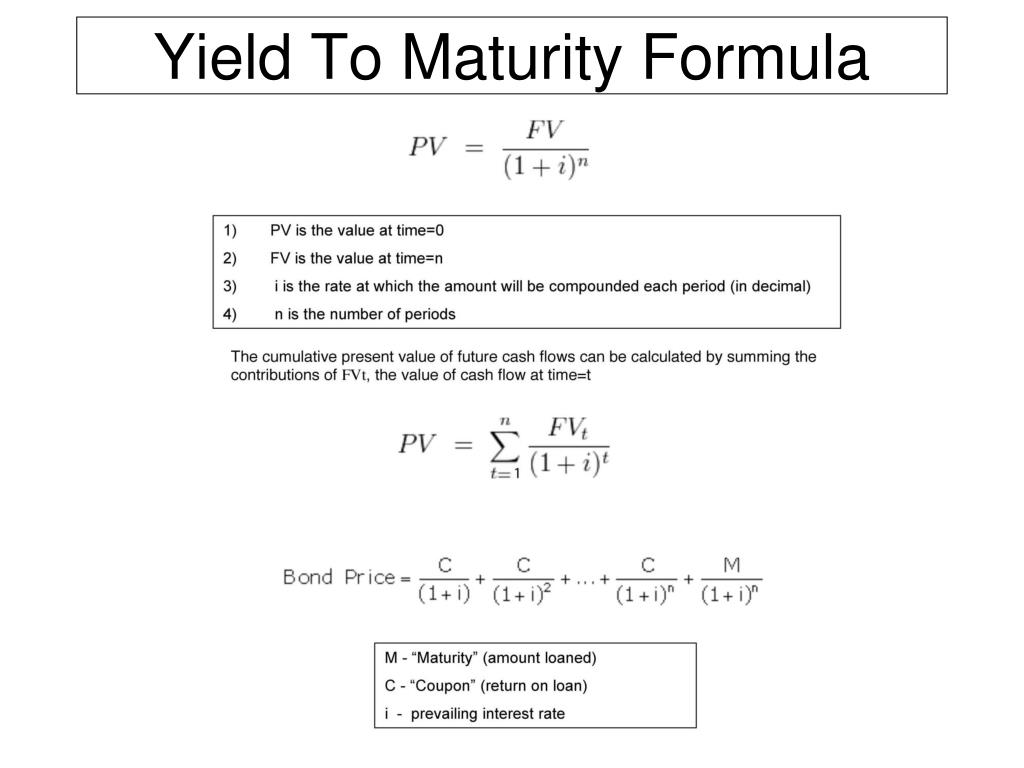

Yield to Maturity (YTM) Definition A bond's yield to maturity (YTM) is the internal rate of return required for the present value of all the future cash flows of the bond (face value and coupon payments) to equal the current bond ...

Ytm and coupon rate

Difference Between YTM and Coupon rates Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author. Yield to Maturity vs Coupon Rate: What's the Difference The YTM considers market changes because, even though your bond's interest rate will not change, its value will fluctuate depending on the market's rates. You need to know the coupon rate, the price of the bond, its value, and the maturity date to calculate the YTM. If you purchase the bond at face value, the YTM and the coupon rate are the ... Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. 1. Overview and Key Difference.

Ytm and coupon rate. Yield to Maturity (YTM) - Meaning, Formula & Calculation Since the bond is selling at a discount, the interest rate or YTM will be higher than the coupon rate. Using the YTM formula, the required yield to maturity can be determined. INR 950 = 40/(1+YTM)^1 + 40/(1+YTM)^2 + 40/(1+YTM)^3+ 1000/(1+YTM)^3. We can try out the interest rate of 5% and 6%. Difference Between Coupon Rate and Yield of Maturity Coupon Rate. Yield of Maturity. 1. The amount paid by the issuer to the bondholder until it's maturity is called coupon rate. The yield of maturity means the total return earned by the investor until it's maturity. 2. The rate of interest is paid annually at a coupon rate. Yield to Maturity (YTM) | Definition, formula and example Yield to maturity (YTM) is the annual return that a bond is expected to generate if it is held till its maturity given its coupon rate, payment frequency and current market price.. Yield to maturity is essentially the internal rate of return of a bond i.e. the discount rate at which the present value of a bond's coupon payments and maturity value is equal to its current market price. Important Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Coupon Rate vs. Yield-to-Maturity. The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when ... Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =. What's the difference b/w coupon rate and YTM? And why do we ... - reddit In this example, since the ytm is less than the coupon rate, the bond must be trading at a premium to its face value. Let's say with a FV of 100, you end up paying 102. Now 5.8% will be the discount rate used to bring back the $6 annual coupon payments and $100 principal repayment back to the present value. Coupon rate is exactly what it says. Coupon vs Yield | Top 5 Differences (with Infographics) The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is $1150, then the yield on the bond will be 3.5%. Coupon vs. Yield Infographic Let's see the top differences between coupon vs. yield.

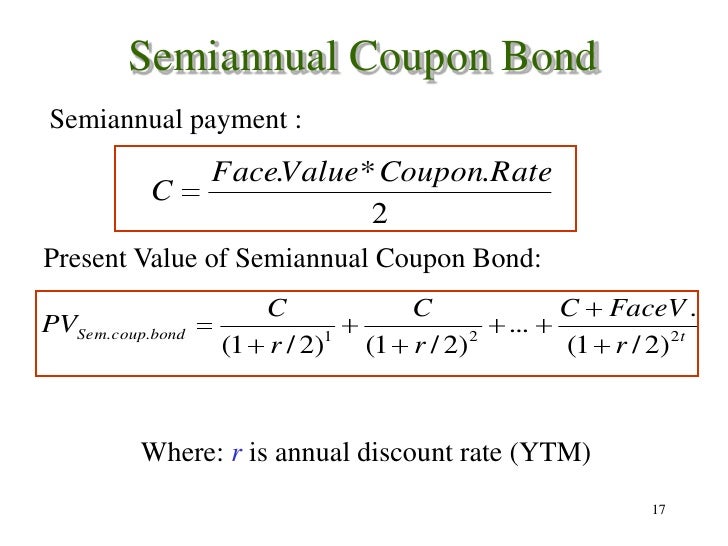

Yield to Maturity (YTM): Formula and Excel Calculator What is the Yield to Maturity (YTM)? The Yield to Maturity (YTM) represents the expected annual rate of return earned on a bond under the assumption that the debt security is held until maturity. From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made on time and are ... Difference Between Coupon Rate and Yield to Maturity (With Table) The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year. Yield to Maturity Calculator | Calculate YTM The YTM can be seen as the internal rate of return of the bond investment if the investor holds it until it matures and reinvests the coupon at the same interest rate. Hence, the YTM formula involves deducing the YTM r in the equation below: bond price = Σ k=1 n [cf / (1 + r) k], where: cf - Cash flows, i.e., coupons or the principal; r - YTM ... Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... A bond's price moves inversely with its YTM. An increase in YTM decreases the price and a decrease in YTM increases the price of a bond. The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate

Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Since bonds do not always trade at face value, YTM gives investors a method to calculate the yield they can expect to earn on a bond. Coupon rate is a fixed value in relation to the face value of a bond.

Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

What is the Difference Between YTM and Coupon rates Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation.

What is the relationship between YTM and the discount rate of a ... - Quora Answer (1 of 3): They can be considered part of the same thing and depends on the type of bond. Yield to maturity is a concept for fixed rate bonds and is the internal rate of return i.e. the rate at which future flows are discounted on a compound basis to give the present value of the bond incl...

Yield to Maturity (YTM) - Definition, Formula, Calculations Step by Step Calculation of Yield to Maturity (YTM) The steps to calculate Yield to Maturity are as follows. Gathered the information on the bond-like its face value, months remaining to mature, the current market price of the bond, the coupon rate of the bond.

Coupon Rate - Meaning, Calculation and Importance This article explains the coupon rate for bonds, its calculation, importance and difference between coupon rate and yield to maturity in detail. ... and all the coupon payments are reinvested at the same rate. Yield to Maturity (YTM) = {(C) + [(FV - PV) ÷ t]} ÷ [(FV + PV) ÷ 2] Where, C - Coupon Payment. FV - Face value of the bond.

Yield to Maturity (YTM) Definition & Example | InvestingAnswers The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn't change. Simply put, it is the total value of ...

Yield to Maturity (YTM) - Meaning, Formula and Examples The formula of current yield: Coupon rate / Purchase price. Naturally, if the bond purchase price is equal to the face value, the current yield will be equal to the coupon rate. Current Yield = 160/2,000 = 0.08 or 8%. Let's say the purchase price falls to 1,800. Current Yield = 160/1,800= 0.089 or 8.9%. The current Yield rises if the purchase ...

Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. 1. Overview and Key Difference.

Yield to Maturity vs Coupon Rate: What's the Difference The YTM considers market changes because, even though your bond's interest rate will not change, its value will fluctuate depending on the market's rates. You need to know the coupon rate, the price of the bond, its value, and the maturity date to calculate the YTM. If you purchase the bond at face value, the YTM and the coupon rate are the ...

Difference Between YTM and Coupon rates Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author.

![[100% Off] Promote & Sell Your Apps: From Beginner To Expert Udemy Coupon - Real Discount](https://www.real.discount/wp-content/uploads/2019/01/752688_4c6c_7.jpg)

Post a Comment for "45 ytm and coupon rate"